LIC Classic Credit Card

A credit card which empowers you to secure your tomorrow while rewarding your today. The card offers supersized rewards on your daily purchases and LIC premium payments. These rewards can be redeemed anywhere online, even to fund your next LIC premium payment. That’s not all, there are lifestyle privileges like airport & railway lounge access, road-side assistance, and insurance cover.

• Complimentary

Domestic Airport Lounge access, once every quarter*

• Complimentary

Railway Lounges access, twice every quarter

• Fuel Surcharge waiver up to ₹200 per

statement cycle for transactions between ₹200 to ₹5,000

• Personal

Accident Cover of ₹2,00,000

• Purchase

Protection Cover, Credit Shield & Lost card liability of ₹25,000 each

• Complimentary Road-Side Assistance worth ₹1,399

Note – Airport lounge access is subject to ₹20,000 spent

in the previous month.

• Lifetime Free Credit Card

• Redeem reward points for flight and hotel bookings via “Travel & Shop” section on the IDFC FIRST Bank Mobile Banking App

• ATM cash withdrawals at ZERO interest until next due date, nominal cash withdrawal fee of ₹199 per withdrawal applicable

• 6X reward points on LIC Insurance premiums

• 3X reward points on your daily essentials like Grocery, Utility bills, Railway bookings, Education & Government payment (Capped to 300 RP pm)

• 45X Bonus Reward Points, over and above usual Credit Card Reward Points on booking hotels via 'Travel and Shop' section on IDFC FIRST Bank Mobile App

• 20X Bonus Reward Points, over and above usual Credit Card Reward Points on booking flights via 'Travel and Shop' section on IDFC FIRST Bank Mobile App

• 3X reward points on other spends

• Redeem reward points for any online purchase including for your next LIC Premium payment

• Reward points have a validity of 3 years

• 1X = 1 Reward Point per ₹125 spent | 1 Reward Point = ₹0.25

• Reward points are not applicable on Fuel, Rent & property management payments, ATM cash withdrawals, Non-LIC insurance premium and EMI transactions.

- 2,000 Rewards on spending first ₹10,000 within 30 days of card generation

- 5% cashback (up to ₹1000) on the transaction value of first EMI done within 30 days of card generation

- Exciting merchant offers worth ₹1,500+

What should I do if my credit card is lost, stolen or damaged?

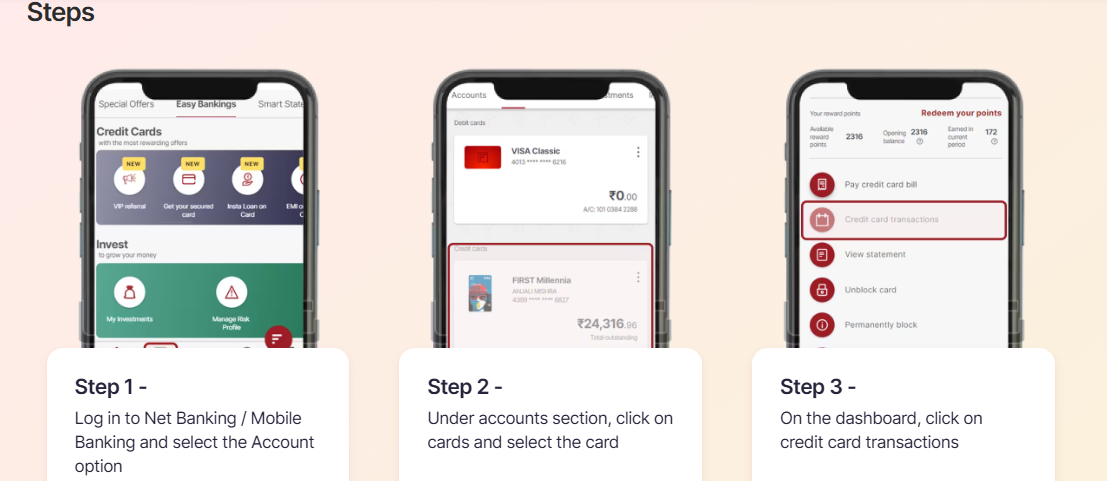

IDFC FIRST Bank offers the facility of blocking and unblocking your credit card from its mobile app or website. You can instantly block your card by following the steps below:

Via Mobile Banking / Internet Banking

1. Once logged in to Mobile/Internet banking, click on Credit Card

2. Select block your credit card option under quick actions menu.

3. Click on Permanent Block.

4. Click the checkbox for card replacement.

Note: Card replacement will incur a charge as per T&C

Via Link:

Click here to instantly block your credit card

Via Customer care:

Please reach on 1800 18 100.

How do I check my transaction history?

How do I change my card PIN?

Using the IDFC FIRST Bank Mobile App:

1. Log in: Open the IDFC FIRST Bank mobile app and log in.

2. Navigate to Credit Cards: Go to the "Accounts" section and then select "Cards".

3. Manage Card: Choose the specific credit card you want to manage and select "Manage Card".

4. Set Preferences: Click on "Set Preferences".

5. Set PIN: Select "Set PIN" to generate a new PIN or change your existing one.

6. Follow prompts: Enter the required details, such as your card information and the new PIN, and confirm the action.

Using Customer Service:

1. Call the toll-free number: Dial 1800 10 888.

2. Select language and option: Choose your preferred language and then select the option for "Bank Account details".

3. Authenticate: Authenticate yourself by entering your date of birth or existing PIN.

4. Select PIN generation: Choose the option for "PIN generation".

5. Create PIN: Enter your new 4-digit PIN and re-enter it for confirmation.

Using an ATM:

1. Visit an ATM: Go to any IDFC FIRST Bank ATM and insert your credit card.

2. Select option: Choose the "Forgot/Generate new ATM PIN" option.

3. Enter OTP: Enter your registered mobile number and the OTP received on your phone.

4. Set PIN: Follow the prompts to create your new PIN.